Archive

Is The Walmart & Google Partnership Agentic Commerce’s Inflection Point?

A big news day on Monday at NRF 2026. And perhaps the start of an inflection point for agentic commerce. And maybe the beginning of a Retail Media Reckoning.

I’ve been waiting for this news to drop about Walmart and Google’s agentic commerce integration within Gemini. It marks a seismic shift in how retailers will compete for consumer attention. And for Brands and Sellers, this news will compress, flatten, and speed up the funnel, but more on that later. Make no mistake: this partnership is less about technology and more about first-party data asymmetry, and may fundamentally rewrite the Retail Media playbook.

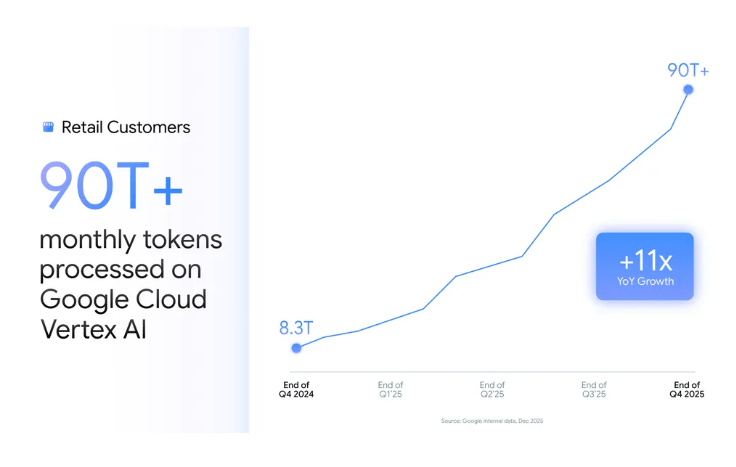

Here’s the reality check: Google’s own data reveals that retail clients are consuming 90 trillion monthly AI tokens! (according to Google’s Sundar Pichal’s blog post today) A staggering jump from 8.3 trillion in December 2024. Yet Google itself frames this as “evolution, not revolution.” That’s the tell. The scale is undeniable, but the adoption velocity and maturity still lag the hype cycle. And in my opinion should be the final proof point that data has flipped the script on Retail media, which used to be about shelf control and sponsored placements. Data has turned it into a growth operating system

Walmart’s Unfair Advantage

Walmart enters this moment with assets competitors can’t replicate overnight: 270 million weekly customers, 19 years of omnichannel transaction data, and Sam’s Club membership loyalty insight data. By embedding shopping directly into Gemini, Walmart isn’t just gaining a distribution channel; rather, it’s reclaiming shopper intent that previously escaped to Google Search! The Universal Commerce Protocol gives Walmart something Amazon has guarded fiercely: direct pipeline access to consumer moments of intent, without the search intermediary tax.

More importantly, Walmart’s ability to personalize across online, in-store, and membership data and complete fulfillment in 30 minutes or three hours creates a closed-loop system (prediction: and a future moat) that will train Gemini’s models on conversion patterns Amazon can only theorize about (for now). This creates a data compounding advantage for Walmart.

What Amazon Should Actually Fear

I’ve led WPP’s global Amazon Ads business for several years and know that their ad business thrives on search intent clarity and lower-friction conversion in a walled garden. This new Walmart model threatens both. And that won’t go unnoticed or defended.

IF Gemini successfully routes commerce conversations to Walmart, Amazon will lose (perhaps only for the moment) the discovery-to-purchase funnel it has long dominated and enjoyed extracting advertiser value for over the past several years. But here’s the catch: Amazon, being Amazon, will pivot to OpenAI very aggressively (as they’re already doing with ChatGPT), fragmenting the agentic commerce landscape. Instead of one AI shopping assistant, we’ll have competing LLM ecosystems with embedded retail loyalty wars. And viola! Friction returns. Where does this leave OpenAI? At the moment, they are out in the cold when it comes to the fastest-growing media segment. Since I’m a cyclist, I would equate this to being dropped by the peloton…and now they have more work to do to get back drafting from the group if they can.

The Retail Media Earthquake

For retailers outside Walmart/Amazon, this is terrifying and a clarifying moment. Retail media programs (and a few companies’ businesses that have piggybacked on this) built entirely on search and social will become secondary channels. Smart retailers will urgently need to:

Rethink search strategy: Search’s role diminishes when shopping intent lives inside Gemini. Brands will shift budgets from paid search to “agentic commerce placements” – unleashing a new arms race without standardized metrics yet. (How will that be monetized?)

Accelerate first-party data: You can’t compete on Walmart’s or Google’s terms, but you can own your own shopper context. Retailers must rapidly build unified customer profiles across channels or become permanent tenants in someone else’s mall.

Retool shopper programs: Dynamic bundling, AI-powered recommendations, and contextual (hello Seedtag?) merchandising become mere table stakes. The demise of static promotional calendars has probably arrived.

My Three Predictions

1. Scaling will take 18-24 months longer than anticipated, with hidden costs (ie, scaling delays=opportunity cost). The 90-trillion-token data point proves AI commerce activity is accelerating, but Google’s own “evolution, not revolution” framing is instructive. Gemini adoption for true transactional commerce is still embryonic. User behavior training, reliable attribution across devices, and liability resolution when Gemini recommends the wrong product remain unsolved. Retailers betting their 2026 retail media strategy on agentic commerce as a primary channel will be disappointed.

2. The retail media margin compression is inevitable, but only for second-tier players. Walmart, Amazon, and a handful of platform retailers (ie, Kroger/84.51) will command premium rates because they have unmatched customer data and fulfillment speed. Everyone else becomes a cost-per-transaction commodity. Brands will consolidate spend to a narrower set of retail partners, shrinking the addressable market for mid-tier retail media networks.

3. Privacy regulation will become the hidden bottleneck. Gemini’s ability to personalize shopping recommendations will depend on cross-domain data sharing that government regulators (IMO they don’t fully understand) are actively tightening (EU Digital Markets Act, California regulations). By 2027, expect significant friction around what data retailers can share with Google or other AI platforms for agentic commerce. The real winner may not be Walmart but rather regulatory arbitrage. And maybe clean room vendors (Liveramp, AWS, Snowflake, etc.).

Bottom Line

I love this partnership as it shows the strategic value of smart partnership leaders that understand what is happening at the intersection of data, ad-tech, media, retail media and shopper and AI to transform and evolve this space – especially since it’s my speciality! And it’s just the beginning of agentic commerce, and another reason I love working in this space and playing in this intersection. There is SO MUCH to do. Welcome to the 1st inning. Retail media’s spoils over the next three years will belong to those who treat this as an urgent signal to invest in owned-media capabilities and first-party data infrastructure, not those betting their strategies on being featured in someone else’s AI assistant.

The Streaming Ad Market is Consolidating Around One DSP”

The Amazon DSP (they hired an agency to come up with a better name) is consolidating the streaming ecosystem in ways many advertisers haven’t yet fully recognized.

For years, effective streaming strategies required juggling disconnected platforms—Prime Video, FAST channels, live content apps, and proprietary devices. That fragmentation is ending. Over the past 18 months, Amazon has unified nearly every major streaming partner and publisher into a single DSP, from premium networks and live sports to free ad-supported channels.

The scale is significant. Amazon DSP reached 275 million monthly ad-supported customers in the US as of October 2024, with advertising revenue jumping 22% to $15.7 billion in Q2 2025. Recent integrations include Spotify (October 2025), Netflix (launching Q4 2025), and Disney (June 2025)—consolidating the major premium streaming players into one buying platform.

This matters operationally and strategically. Advertisers can now plan, buy, and measure across a substantial portion of the streaming landscape from one platform.

That’s worth repeating

This matters operationally and strategically. Advertisers can now plan, buy, and measure across a substantial portion of the streaming landscape from one platform.

By combining premium inventory with first-party retail data, deterministic measurement, and consolidated execution. The result: greater precision, faster scaling, and immediate visibility into performance.

With the exception of YouTube, Amazon DSP now reaches more of the streaming landscape than any other platform—with superior data integration, tighter partnerships, and more flexible inventory structures.

The strategic shift is clear: streaming buying is moving from channel-by-channel planning to full-funnel, outcome-based strategy. Brands and agencies that move first will capture disproportionate value.

Don’t take my word. Here are two strong sources that support my POV:

- On DSP consolidation & Netflix/Spotify integrations: https://ppc.land/netflix-becomes-available-in-amazon-dsp-starting-q4-2025/

TL;DR – This covers Netflix’s programmatic partnership with Amazon DSP launching Q4 2025, and notes that Amazon DSP reached 275 million monthly ad-supported customers in the US as of October 2024, with advertising revenue jumping 22% to $15.7 billion in Q2 2025.

- On Amazon’s market dominance strategy: https://digiday.com/marketing/with-microsoft-in-tow-amazons-dsp-tightens-its-grip-on-the-open-web/

TL:DR – This explores how Amazon is consolidating programmatic marketplace inventory into its DSP, with pricing power and first-party retail data creating a compelling value proposition for advertisers. Digiday

Bonus data points from searches:

- Amazon DSP added Spotify’s 696 million monthly users to its ecosystem in October 2025 PPC Land

- Amazon has systematically assembled premium connected TV inventory including NFL Thursday Night Football and Disney programmatic access CTOL Digital Solutions

I’d love to hear your thoughts – drop me a line or ping me on LinkedIn